In the crunch time for taxes, the overheads seem to go higher since you are up for the last minute getting your financial house in order. A freelancer, small business owner, or even a self-employed person gets the late rush feeling at that moment when it is just around the deadline for filing taxes because QuickBooks makes tax preparation completely easy even under time constraints. It makes tracking expenses, organizing financial info, and connecting with experts take away some stress that may bring penalties for errors possible.

Why Last-Minute Tax Preparation Can Feel Like A Crisis

Many individuals and business entrepreneurs tend to run back and forth to the tax deadline because of:

- Overloaded Schedules: Prospective tax preparations will repeatedly be relegated to the bottom of the to-do list for more immediately pressing concerns.

- Complex Financial Situations: With time, it appears that one is left hanging between income juggles before qualifying the deductions eligible and before finally tracking the expenses.

- Disheveled Record-Keeping: has been running around just before the deadline in search of receipts and invoices, which is usually a time waster.

These very common bothers were successfully cured by digitizing the entire function of your expenses and monitoring the same in real-time with QuickBooks. The objective is to have a smoother tax return with less stress.

Easier Expense Tracking

Receipt and expenditure management are some of the most tedious elements of tax preparation. QuickBooks smoothens the journey thus:

- Automatically organizes and categorizes the transactions in your linked bank and credit card accounts.

- Keep an ongoing tally of what you could deduct on your taxes so you don’t miss a deduction.

- Digital copies of your receipts are stored within the application, thus eliminating the need for paper clutter.

- Easy-ready tax reports that create a clear picture of your overall financial health.

- Catching all places where you can save money.

This means that each day throughout the year, you get to know exactly what qualifies as a business deduction, such as a meal, travel, and office supplies when it comes to tax time.

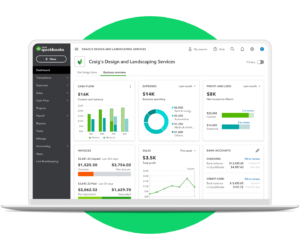

Organized Throughout the Year

Through this software, QuickBooks encourages you to plan financially by:

- Generates Income and Expenditure, Overall Gain Reports.

- Integrate with any of the considerable tax programs such as TurboTax for easy and fast filing.

- Customizable invoices and mileage tracking ensure that not even a penny places itself between a deduction and its potential refund.

- Having real-time dashboards for cash flow monitoring and where savings opportunities may arise.

- Bank reconciliation features that help you keep your finances in check with your bank statement.

These tools are specifically helpful for freelancers and small businesses managing multiple income streams so that they don’t end up scrambling at the last minute.

Maximize Your Tax Deductions

In general, QuickBooks tracks these common deductible expenses:

- Home office for remote workers.

- Business mileage and travel expenses for the occasional business trip.

- Office supplies or equipment, including laptops and software.

- Marketing and advertising expenses, for example, the website and promotional materials.

- Health insurance premiums and retirement contributions for the self-employed.

- Education and self-development expenses such as workshops and seminars.

By providing a mechanism to keep track of these deductions, QuickBooks reduces your taxable income and increases your chances to save.

Expert Help When You Need It

Trying to figure out taxes on your own isn’t ever easy, so with QuickBooks Live Expert Assisted support, specialized help is on hand to lend a helping hand in the process. The possible benefits include:

- Personalized tax advisors that look at your specific situation.

- Step-by-step guidance to complete accuracy and fullness for your tax return.

- Right when you need it with anything tax-related.

- Compliance tips and advice to help you steer clear of IRS headaches.

- This expert help can be handy particularly for newcomers doing their self-employment taxes.

- QuickBooks Live Expert Assisted support is available when signing up with our affiliate link, offering you more personalized assistance throughout your tax filing.

Solutions for Different Scenarios

QuickBooks offers custom solutions targeted toward easing tax filing for many different fields; in particular:

- Freelancers & Independent Contractors: Tracking income, calculating estimated quarterly taxes, and generating 1099 forms made it easy.

- Small Business Owners: Separate business and personal finances; prepare year-end financial statements; tax benefits specific to helping small businesses grow.

- Real Estate Professionals: Track mileage for property visits while categorizing advertising and commission expenses.

- Uncluttering the tax process to fit the needs of your industry, is what QuickBooks aims for.

- E-commerce Sellers: Sync transactions with different platforms, like Shopify and Amazon, along with the automatic tracking of inventory expense and sale taxes.

Avoiding Common Tax Filing Mistakes

Even when you’re in a rush to file, correctness is essential. QuickBooks helps you avoid common tax errors, such as:

- Not reporting all sources of income: QuickBooks integrates different sources of income to ensure nothing is left out.

- Missing out on deductions: Automated expense tracking ensures that all expenses that might qualify are accounted for.

- Being wrong with tax calculations: QuickBooks makes accurate estimations based on current business data.

- Not meeting deadlines to file: Maintenance of alerts to remind filing deadlines.

- Mixing personal and business expenses: Keep personal life separate from work with QuickBooks.

- Forgetting to pay your quarterly taxes: Use estimated payment reminders to coerce yourself.

- Using QuickBooks makes your tax filing less cumbersome and stress-free.

What Makes QuickBooks a Smart Choice for Tax Preparation

Though there are other tax prep programs, QuickBooks is set apart by its

Simple, straightforward design that is easy to learn for anyone.

- Scalability for freelancers, startups, and growing businesses.

- Seamless integration with tax software like TurboTax.

- Cloud-based access for managing your finances from anywhere.

- Advanced security protocols to keep your financial data safe.

Special Offer: Start QuickBooks now with a special offer of 30% discount and get 30 days of QuickBooks Live Expert Assisted when signing up with our affiliate link.